Content

- Example of allowance for doubtful accounts

- Pareto Analysis Method

- What is allowance for doubtful accounts?

- Microsoft Allowance for Doubtful Accounts Example

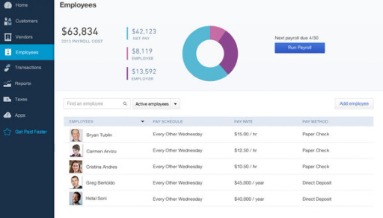

- How to Automate Your Accounts Receivable Process for Accelerated Cash Flow

- How do I record Uncollectible Accounts Receivable in my accounting records?

- Why Estimating Allowance for Uncollectible Accounts Matters

Because it is an estimation, it means the exact account that is uncollectible is not yet known. The final point relates to businesses with very little exposure to the possibility of bad debts, typically, entities that rarely offer credit to its customers. Assuming that credit is not a significant component of its sales, these sellers can also use the direct write-off method. The companies that qualify for this exemption, however, are typically small and not major participants in the credit market.

Regardless of the approach, both bad debt expense and the allowance for doubtful accounts are simply the result of estimating the final outcome of an uncertain event—the collection of accounts receivable. The allowance method is considered a less aggressive and, in some industries, more acceptable method for writing off debt. It relies on the premise that the amount of bad debt can be accurately estimated based on historical accounting data. A transaction and its related bad debt expense are then recorded in the same time period, making the financial statements a more accurate record of transaction profitability. Estimating uncollectible accounts Accountants use two basic methods to estimate uncollectible accounts for a period.

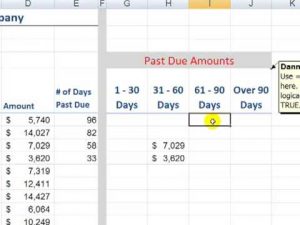

Example of allowance for doubtful accounts

Most companies use the allowance method, which is to estimate the amount of doubtful expense it expects. This is done to be in compliance with the matching principle which requires that revenues be matched to their related expenses within an accounting period. When this bad debt is written off, the allowance for doubtful accounts is credited by the write-off amount. If, however, a company uses the direct write-off method, it will credit accounts receivable to write off the bad debt. Because the time difference between the sale and the time a company realizes an account is uncollectible is usually long, using the direct write-off method will violate the matching principle.

The unpaid accounts receivable is zeroed out at the end of the year by drawing down the amount in the allowance account. Bad debt expense is account receivables that are no longer collectible due to customers’ inability to fulfill financial obligations. There are two distinct ways of calculating bad debt expenses – tBad debt expense is account receivables that are no longer collectible due to customers’ inability to fulfill financial obligations. There are two distinct ways of calculating bad debt expenses – the direct write-off method and the allowance method.he direct write-off method and the allowance method.

Pareto Analysis Method

Given that the Allowance account had a $2,000 credit balance prior to adjustment, the required entry is for $17,700, or the difference between $19,700 and $2,000. If more accounts are written off than previously estimated, the Allowance account will have a temporary debit balance prior to the year-end adjustment. This estimate is usually recorded through an adjusting journal entry at year-end. Under the allowance method, the uncollectible account expense for the period is matched against the sales for that period.

In addition, the company should re-examine how it manages credit extended to customers. If the company’s bad debt reserve is too high, investors may lose confidence in the company’s ability to work with a reliable customer base and ensure collection for products or services provided. Allowance for doubtful accounts falls under contra assets and not the current assets section. allowance for uncollectible accounts formula A contra-asset account means its balance will either be zero or negative . Being proactive with your e-invoicing and collections process is the easiest way to reduce the number of doubtful or delinquent accounts. A reliable AR automation solution can help you achieve better cash flow, lower bad debt, and improve profits by analyzing customer behavior, risk, and past data.

Where is allowance for uncollectible accounts on balance sheet?

Allowance for doubtful accounts fall under the contra assets section in the balance sheet, meaning it can either be zero or negative.

Deja una respuesta